Understanding Corrective Waves – A Natural Market Rhythm

Learner: We’ve covered the five-wave impulse pattern, but markets don’t always move in that direction. Can you explain what happens during corrective waves?

Tutor: Excellent question. Corrective waves are just as important as impulse waves, perhaps even more challenging to navigate. Think of them as the market’s way of “catching its breath” after a strong directional move. They’re called corrective waves because they move counter to the larger trend, correcting or retracing part of the previous impulse move.

Learner: So they’re basically just three waves moving in the opposite direction?

Tutor: While the basic pattern is three waves – labeled A, B, and C – corrective waves are actually more complex than impulse waves. They come in several variations and can be quite tricky to identify in real-time. The key is understanding that corrections are working against the larger trend, which creates more variety in their structure.

Learner: What makes them more complex than impulse waves?

Tutor: Unlike impulse waves, which generally follow a more straightforward five-wave structure, corrective waves can take multiple forms:

- Simple corrections (Zigzag, Flat, Triangle)

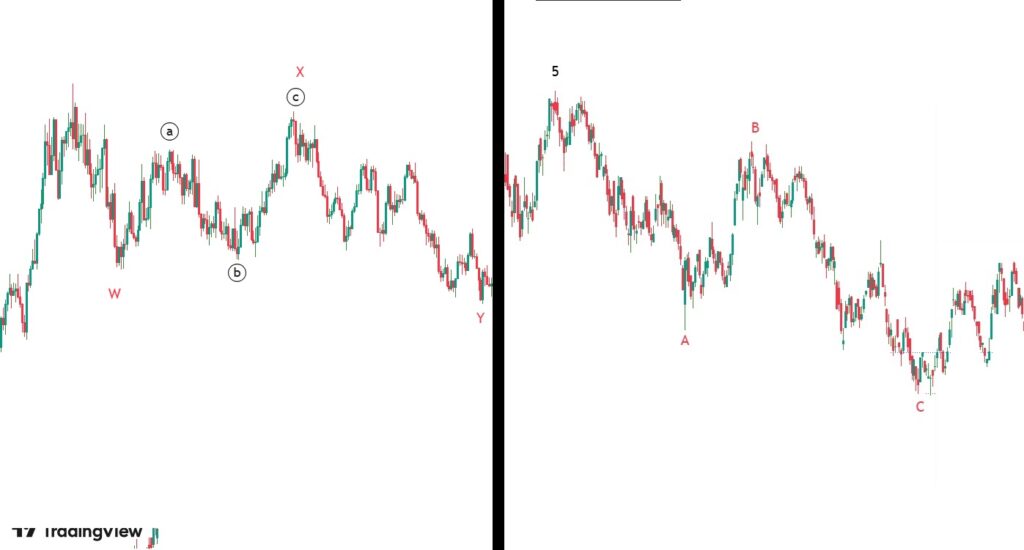

- Complex corrections (Double and Triple combinations)

- Hybrid patterns

Each of these has distinct characteristics and follows specific rules. The market’s psychology during corrections is more uncertain, which creates these varied patterns.

Learner: Could you break down the simple corrections first?

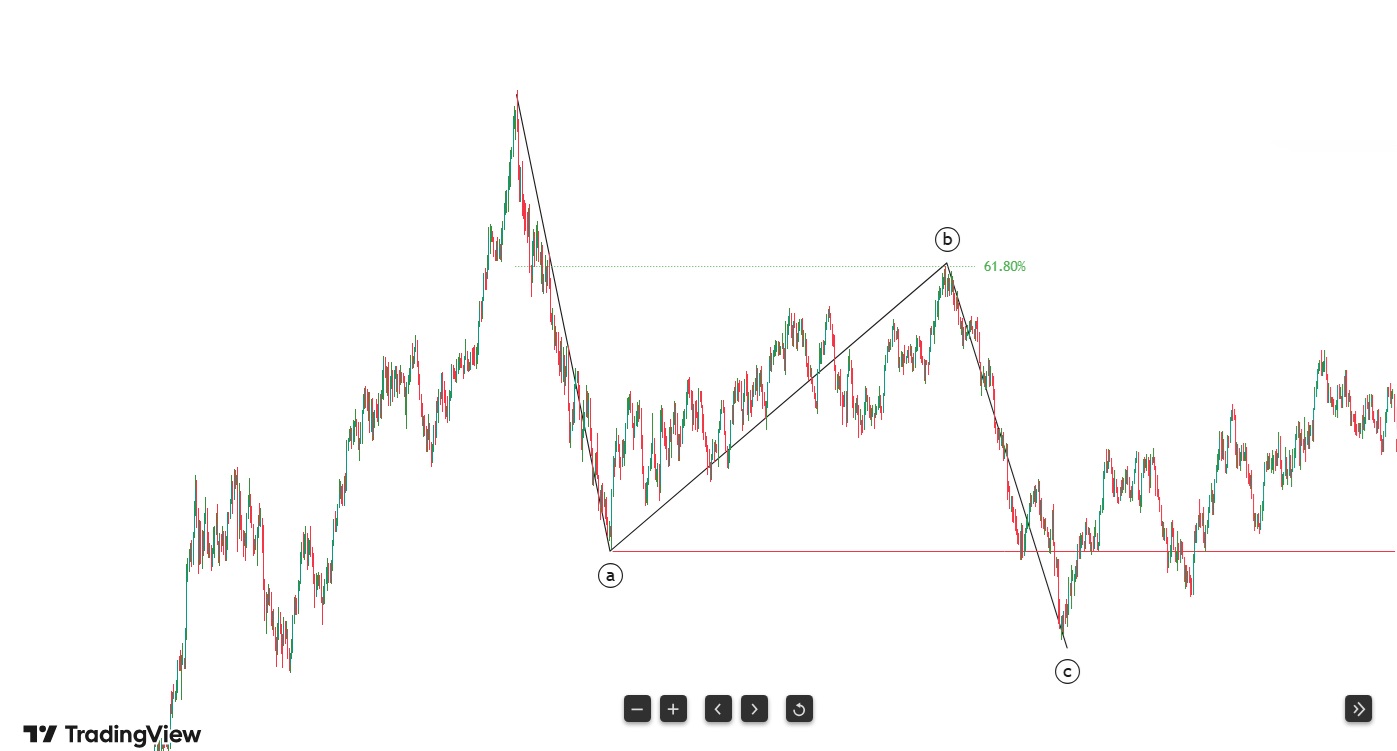

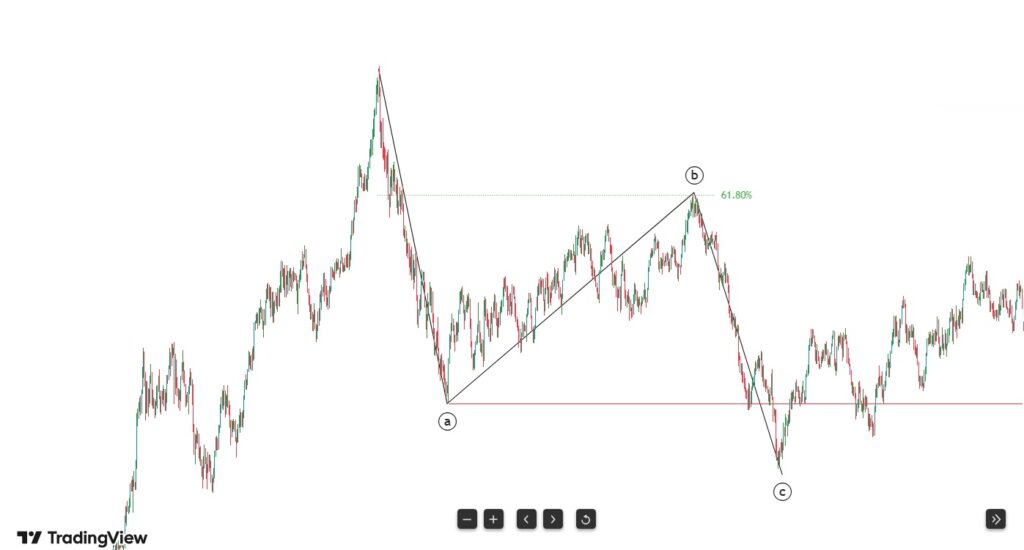

Tutor: Let’s start with the most common type – the Zigzag pattern. In a Zigzag:

- Wave A is a five-wave structure moving against the trend

- Wave B is a three-wave structure retracing Wave A

- Wave C is another five-wave structure in the same direction as Wave A

The key characteristic of a Zigzag is that Wave B typically retraces less than 61.8% of Wave A, and Wave C often extends beyond the end of Wave A.

Learner: What about Flat patterns? How are they different?

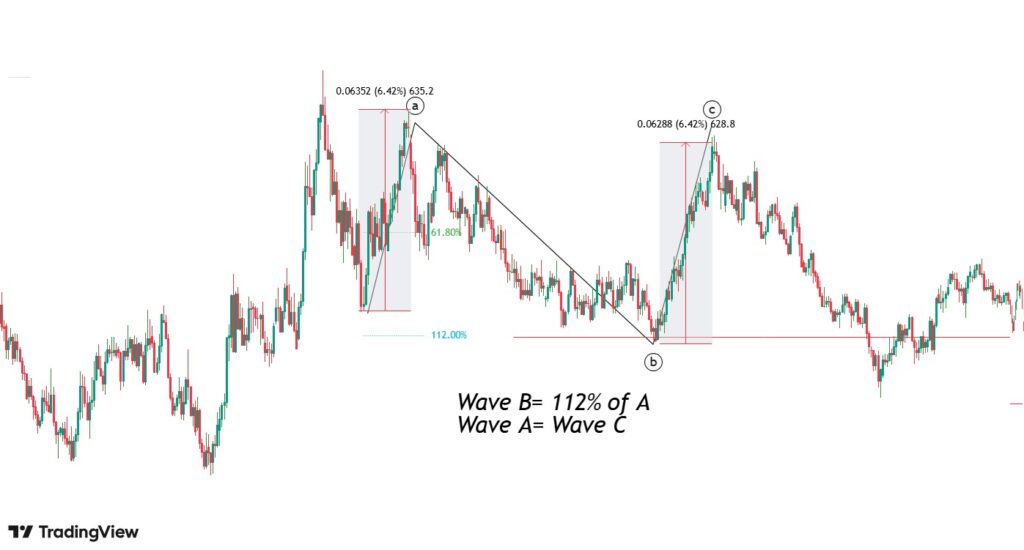

Tutor: Flat patterns are fascinating because they show more equality between waves. In a regular Flat:

- Wave A is a three-wave structure

- Wave B retraces 90% or more of Wave A

- Wave C is a five-wave structure approximately equal to Wave A

There are also variations like Expanded Flats and Running Flats, where these relationships vary in specific ways. The key is that Flats generally show more sideways movement than Zigzags.

Learner: You mentioned Fibonacci relationships. How do they apply to corrective waves?

Tutor: Fibonacci ratios are crucial in corrective wave analysis. The most common relationships we look for are:

- Wave B typically retraces 61.8% or 78.6% of Wave A

- Wave C often extends to 61.8%, 100%, or 161.8% of Wave A

- In complex corrections, the entire pattern often relates to the previous impulse wave by these same ratios

These relationships help us project potential turning points and validate our wave count.

Learner: What are the common mistakes traders make with corrective waves?

Tutor: The biggest pitfalls include:

- Mistaking the end of Wave B for the end of the entire correction

- Assuming all corrections will be simple ABC patterns

- Getting too focused on exact Fibonacci levels without considering the broader context

- Failing to recognize when a correction is developing into a complex pattern

Remember, corrections are about probability, not certainty. The market can always develop more complex patterns than initially anticipated.

Learner: How can we improve our accuracy in identifying corrective waves?

Tutor: Here’s a systematic approach:

- First, identify the larger trend context

- Look for characteristic wave structures (threes vs fives)

- Apply Fibonacci retracement tools

- Monitor volume patterns (corrections typically show declining volume)

- Watch for pattern completion signals

- Always consider alternative counts

Most importantly, maintain flexibility in your analysis. Corrections can morph from one pattern to another, so staying adaptable is crucial.

Learner: What role does volume play in corrective waves?

Tutor: Volume typically decreases during corrections, which makes sense psychologically. During impulse waves, there’s clear directional conviction, but corrections represent uncertainty and consolidation. You’ll often see:

- Declining overall volume through the correction

- Lower volume in Wave B compared to Waves A and C

- A volume spike near the end of Wave C, signaling potential completion

Learner: Any final wisdom about trading corrective waves?

Tutor: Yes, and this is crucial: Corrections are often better opportunities for positioning than for active trading. They’re the market’s way of building energy for the next impulse move. The best strategy is usually to:

- Identify the correction early

- Determine its most probable pattern

- Wait for completion signals

- Position yourself for the next impulse wave

Remember, patience during corrections often leads to better opportunities than trying to trade every minor movement.

Key Takeaways:

- Corrective waves move against the larger trend in three main waves

- They come in simple and complex variations

- Fibonacci relationships help validate wave counts

- Volume typically decreases during corrections

- Patience and pattern recognition are crucial for trading success

- Always consider the larger trend context

- Be prepared for patterns to develop more complexity