Decoding Extended, Diagonal, and Truncation waves

Learner: I’ve mastered the basic five-wave impulse and ABC corrections. Now, what makes advanced wave patterns different? How do traders spot these complex formations?

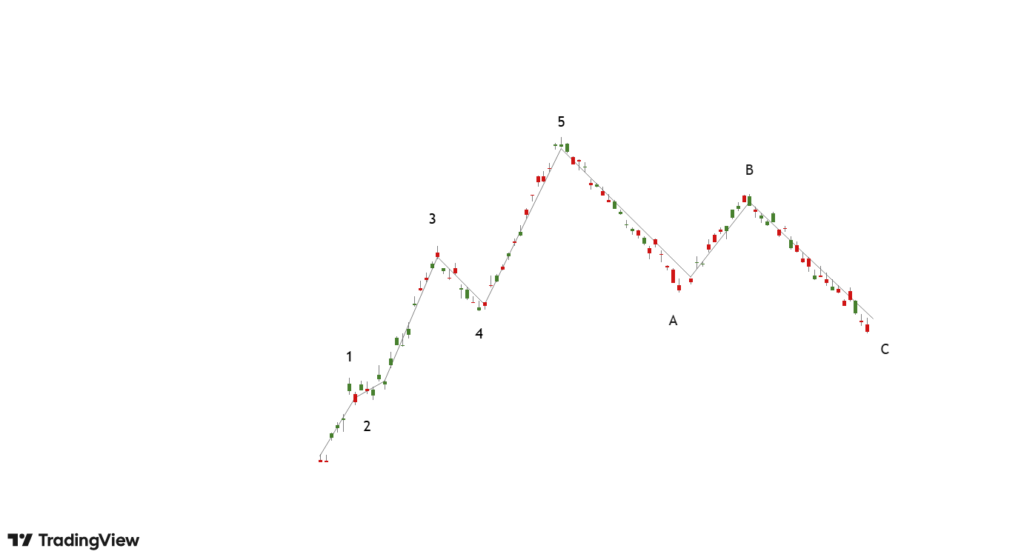

Tutor: Great question! Advanced patterns add layers of nuance to Elliott Wave analysis. These include extended waves, truncated fifths, and diagonal triangles. They challenge conventional wave-counting rules but offer high-reward opportunities for disciplined traders. Let’s unpack each pattern systematically.

1. Extended Waves: When the Trend Overachieves

Learner: What exactly is an extended wave?

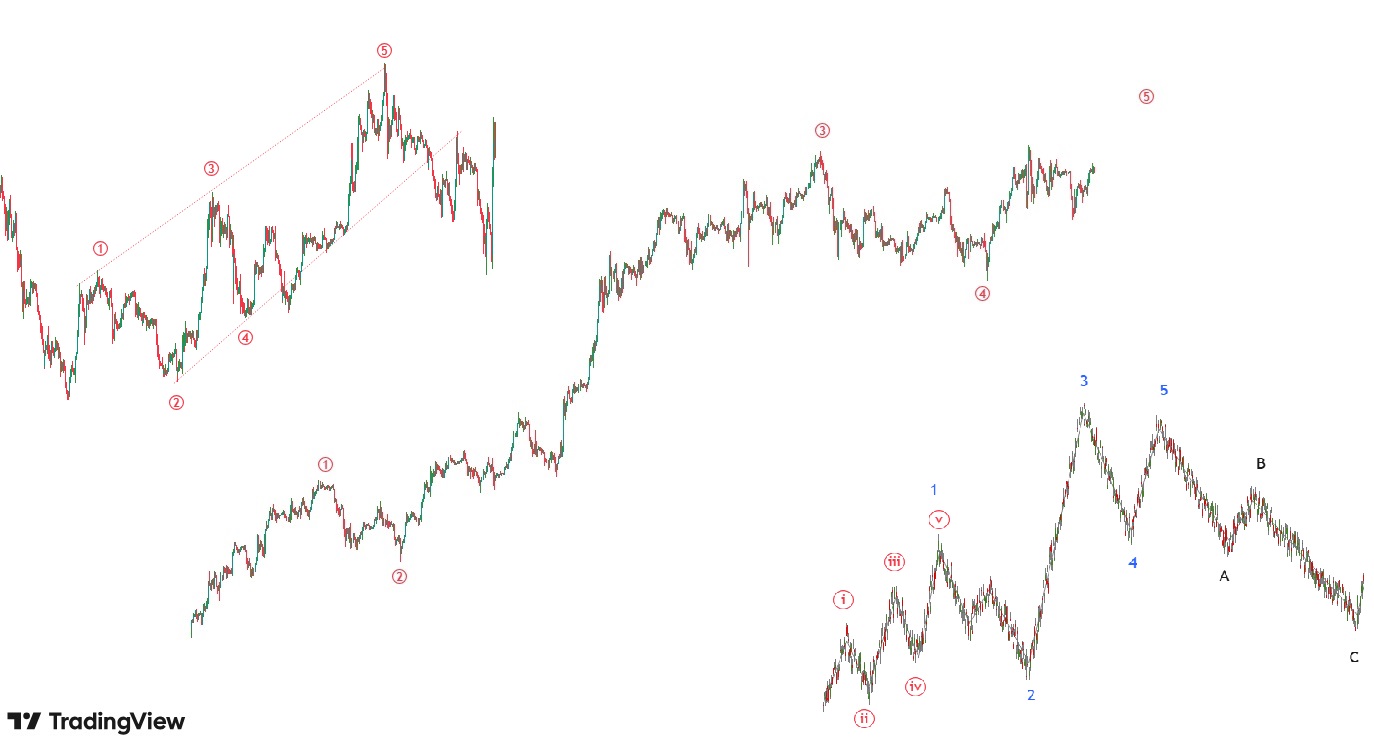

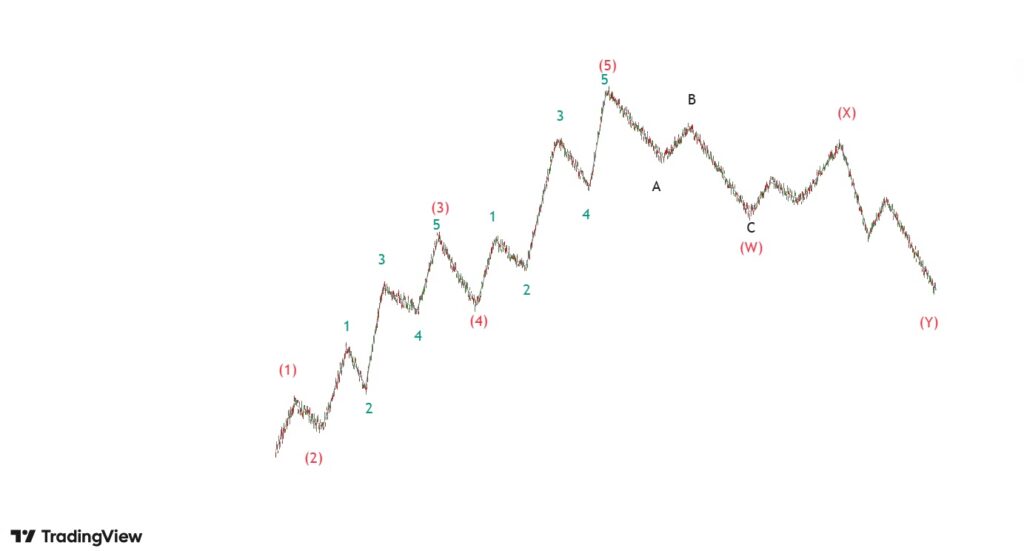

Tutor: An extended wave occurs when one of the impulse waves (typically Wave 1, 3, or 5) subdivides into five smaller waves instead of three. This “wave within a wave” structure signals exceptional momentum. For example, in a bull market, an extended Wave 3 might split into five sub-waves, driving prices far beyond initial targets.

Learner: How do Fibonacci ratios apply here?

Tutor: Extended waves often correlate with Fibonacci extensions (161.8%, 261.8%). If Wave 1 extends, Wave 3 might reach 161.8% of Wave 1’s length. Similarly, an extended Wave 5 could stretch to 261.8% of Waves 1-3 combined. These ratios help traders set profit targets.

2. Truncated Fifths: The False Finish

Learner: I’ve heard of “truncated fifths.” What causes them?

Tutor: A truncated fifth (or “failed fifth”) occurs when Wave 5 fails to surpass Wave 3’s high (in an uptrend) or low (in a downtrend). This signals exhaustion in the prevailing trend and often precedes sharp reversals.

Learner: How can traders avoid mistaking this for a normal correction?

Tutor: Watch for two signs:

- Volume Divergence: Declining volume during Wave 5 despite rising prices.

- Momentum Shifts: RSI or MACD showing bearish divergence.

Common Pitfall:

Assuming the trend will continue post-Wave 5. Always wait for confirmation (e.g., a break below Wave 4’s low).

3. Leading and Ending Diagonals: The Wedge Patterns

Learner: Diagonals confuse me. How do they differ from regular impulse waves?

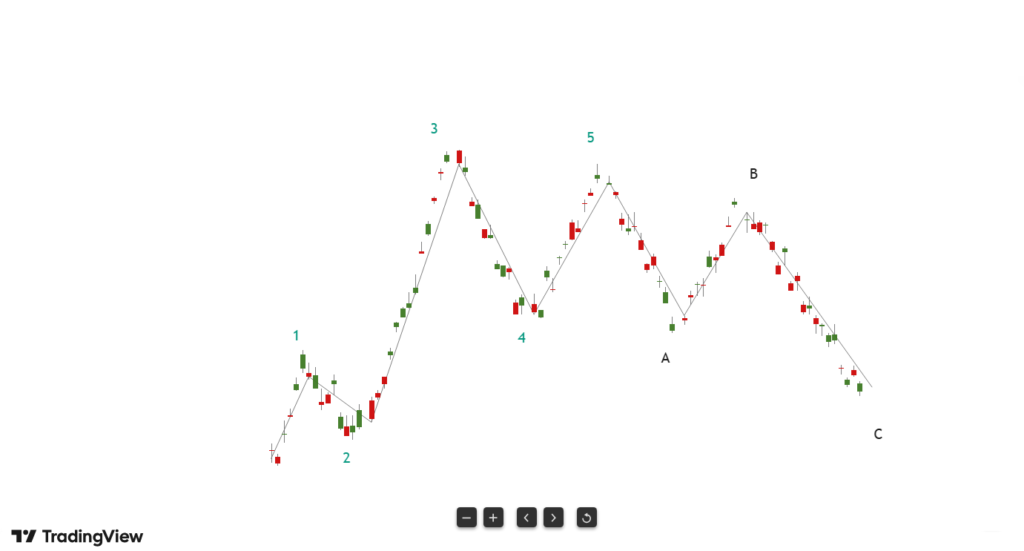

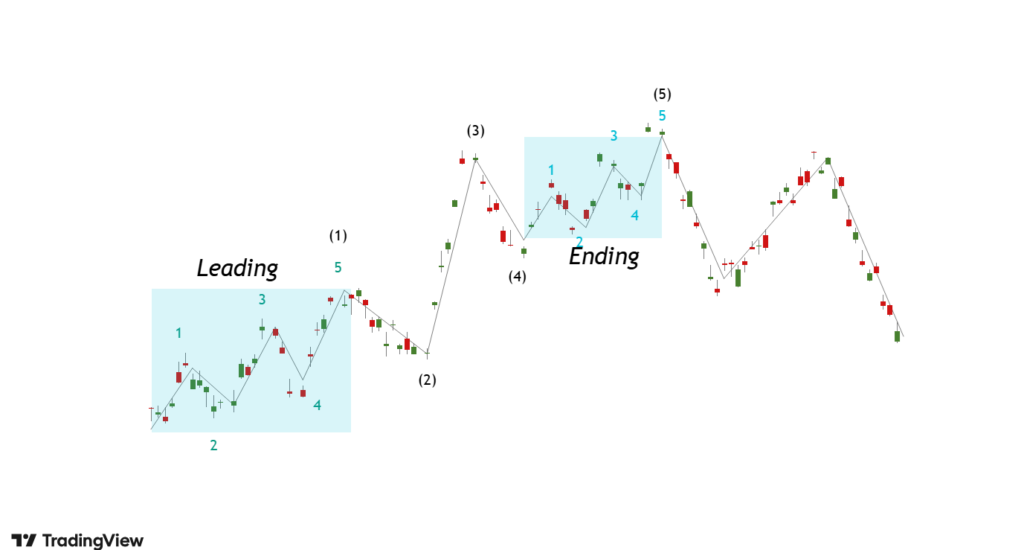

Tutor: Diagonals are wedge-shaped patterns with overlapping waves. There are two types:

- Leading Diagonals: Appear in Wave 1 or A, signaling trend exhaustion early.

- Ending Diagonals: Form in Wave 5 or C, marking the final push before reversal.

Key Rules:

- All sub-waves must be zigzags (no impulses).

- Wave 4 always enters Wave 1’s price territory.

Trading Strategy:

For ending diagonals, prepare for a reversal once Wave 5 completes. Place stop-losses beyond the diagonal’s trendline.

4. Missing Waves: When the Market Skips a Beat

Learner: Can waves ever be “missing”?

Tutor: Rarely, but yes. In fast-moving markets, Wave 2 or 4 might appear as a brief sideways consolidation instead of a full retracement. This reflects overwhelming sentiment (extreme greed or fear).

Identification Tips:

- Check higher timeframes: The “missing” wave may exist as a smaller-degree pattern.

- Validate with volume: Absence of selling/buying pressure confirms the skipped wave.

Caution:

Missing waves often lead to extended moves. Never force a count—let the market structure guide you.

Psychology Behind Advanced Patterns

Learner: How does market psychology drive these patterns?

Tutor: Extended waves reflect FOMO (fear of missing out), while truncated fifths signal sudden loss of conviction. Diagonals emerge during periods of indecision, and missing waves occur when sentiment becomes one-sided. Advanced patterns are essentially manifestations of crowd psychology extremes.

Trading Strategies for Advanced Patterns

- Extended Waves:

- Ride the extension using Fibonacci extensions as targets.

- Trail stop-losses below the most recent sub-wave low.

- Diagonals:

- Trade the breakout/breakdown from the wedge.

- Combine with volume analysis for confirmation.

- Missing Waves:

- Focus on momentum indicators (e.g., RSI >70 or <30).

- Avoid overleveraging—these setups are volatile.

Key Takeaways

- Extended Waves reveal explosive trends; use Fibonacci extensions for targets.

- Truncated Fifths warn of trend exhaustion; watch for divergence.

- Diagonals predict reversals; trade the wedge breakout.

- Missing Waves require multi-timeframe analysis; don’t force counts.