Understanding Market Rhythms: A Dialogue on Elliott Wave Theory

Learner: Sir, I’ve been watching the markets for a while now, and I keep hearing about Elliott Wave Theory. What makes it so special compared to other analysis methods?

Tutor: That’s an excellent question. Imagine you’re standing by the ocean, watching the waves roll in. Have you ever noticed how they follow a certain rhythm?

Learner: Yes, there seems to be a pattern – bigger waves followed by smaller ones.

Tutor: Precisely! Ralph Nelson Elliott made the same observation about financial markets in the 1930s. He discovered that market movements aren’t random but follow natural laws of rhythm, just like those ocean waves. This rhythm reflects something fundamental about human nature and collective behavior.

Learner: So markets move in waves because of human behavior?

Tutor: Exactly. Markets are driven by human psychology – cycles of optimism and pessimism, confidence and fear. Elliott found that these emotional cycles create predictable patterns in market prices. The basic pattern consists of five waves in the direction of the main trend, followed by three corrective waves.

Learner: Why specifically five waves and three waves? Why not some other numbers?

Tutor: This relates to the Fibonacci sequence, a mathematical pattern found throughout nature – in the arrangement of leaves on a stem, the spiral of shells, and even the structure of galaxies. Each number of that sequence is the sum of two preceding ones (0, 1, 1, 2, 3, 5, 8, 13, …). Observing market movements, Elliott identified key Fibonacci ratios that consistently appeared: 0.618, 1.0, 1.618, and 2.618.

Learner: That sounds almost too perfect. Do these patterns really appear consistently?

Tutor: They do, but here’s where many newcomers get confused. The patterns aren’t always perfect or obvious in real-time. Think of it like music – while there’s a basic rhythm, there are variations, improvisations, and complexities built upon that foundation.

Learner: So how can we start identifying these patterns?

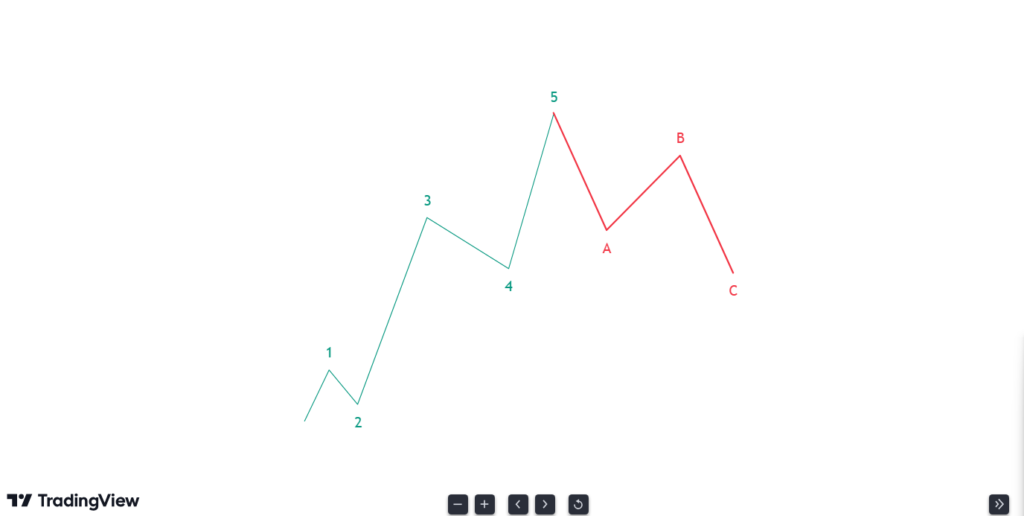

Tutor: Let’s start with the basic structure. The five-wave pattern, which we call an impulse wave, moves in the direction of the main trend. We label these waves with numbers (1-2-3-4-5). The three corrective waves move against the trend and are labeled with letters (A-B-C).

Learner: Are all these waves the same size?

Tutor: No, and this is where it gets fascinating. Each wave has its own personality and typical characteristics. Wave 3 is usually the strongest and longest. Wave 2 never moves beyond the starting point of Wave 1. These aren’t just guidelines – they’re rules that help us validate our wave counts.

Learner: What happens after we complete all eight waves?

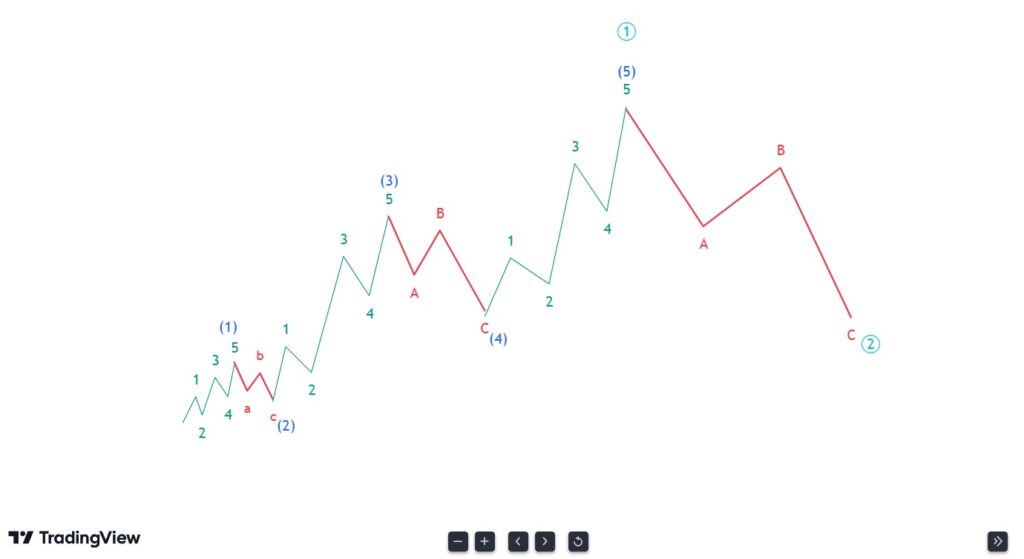

Tutor: The beauty of Elliott Wave Theory is that this pattern repeats at different scales. What looks like a single wave at one zoom level is actually made up of smaller waves when you look closer, and is itself part of a larger wave pattern when you zoom out. We call these different sizes “degrees” of waves.

Learner: It sounds complex. How do we avoid getting lost in all these waves?

Tutor: That’s why we start with the basics and build up gradually. The key is to first master identifying the basic five-wave pattern and the three-wave correction. Everything else builds upon this foundation. Remember, even expert analysts sometimes disagree on wave counts, especially in real-time.

Learner: What’s the most important thing to remember as we begin studying this?

Tutor: Always remember that Elliott Wave Theory is more than just a collection of patterns – it’s a framework for understanding market psychology. The waves reflect the natural rhythm of human emotion and behavior in markets. As you learn more, you’ll start seeing these patterns not just in price charts, but in many aspects of life.

Key Takeaways:

- Elliott Wave Theory is based on natural law and human psychology

- Markets move in predictable patterns of five waves in the trend direction and three waves in correction

- These patterns are fractal, meaning they appear at different degrees or scales

- Wave patterns reflect cycles of human emotion in markets

- Understanding the basic pattern is crucial before moving to complex variations